Contract Control Program™

Full-service and self-service contract operations to fit any budget.

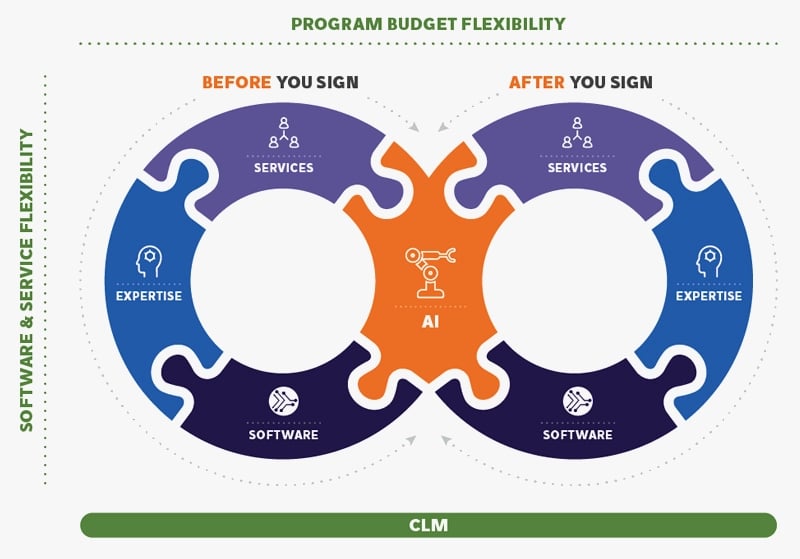

LegalSifter’s Contract Control Program is all about giving you choices and control. Manage contracts using our AI software and playbooks, or let our experts handle everything for you, including redlining and organizing. Get exactly what you need, when you need it on any given work day.

contact us

What's needed to cure contract pain?

AI:

- Speed and quality in contract creation, review, and analysis powered by proven AI models.

- The right AI model that's trained specifically to read and understand contracts.

- Reduce costs with less time spent on each contract and less re-work.

Expertise:

- Negotiation of contracts is still a human-to-human endeavor. You need a “human in the loop” with the expertise to ensure the AI gets it right and makes the right judgment calls.

- You need to drive consistency and mitigate risks with clear and high-quality contract guidance and advice for your teams, playbooks, and templates.

- Unique contract expertise to help identify the contract data you need, how to extract it, and verify that it’s 100% correct.

Software and Services

Software and services alone cannot get it done. You need both.

Software

- Software is the obvious answer and where many start looking. But it's not enough.

- You can go to any of the 200+ CLM vendors to hear the same software value proposition which may work well if you already have quality templates, all your contracts are on your own paper, and you don’t need clean 99%+ accurate data in your legacy and 3rd party contracts in your repository.

- If that’s not the case, you’ll need AI, expertise, and people.

Services

- Our services are delivered by contract experts armed with leading AI technology to:

- Review and negotiate contracts faster and more consistently.

- Get your existing contracts into the system and ensure future contracts are mapped, organized and that clean data is extracted.

- Configure and administer your contract software platform.

The Contract Control Program™

Full service and self-service features that you need.

Budget Flexibility:

- Easily adjust and flex your fixed budget across Before You Sign and After You Sign needs over time.

- Every solution that solves contract pain requires people. It’s simply a measure of whether you provide the people or someone else does.

- Choose your mix of software and services even on a contact-by-contract basis.

- Service delivery is integrated through our solution to create an on-demand extension of your team’s capacity.

Guaranteed Results

Our contract services are managed using lean manufacturing principles that give us the ability to quickly, consistently, and affordably provide redlining services and deliver clean, accurate data on all your contracts.

- Redlining Service Turnaround Times: Send us a draft contract by 1:00 PM US Eastern Time and get it the same day. Send it to us after 1:00 PM US Eastern Time and get it the next day unless expedited.

- Contract Organization and Data Extraction: We ensure your satisfaction with our 99%+ Data Quality Guarantee with LegalSifter Organize. If your data is not at least 99% accurate, we fix it at no additional cost to you.

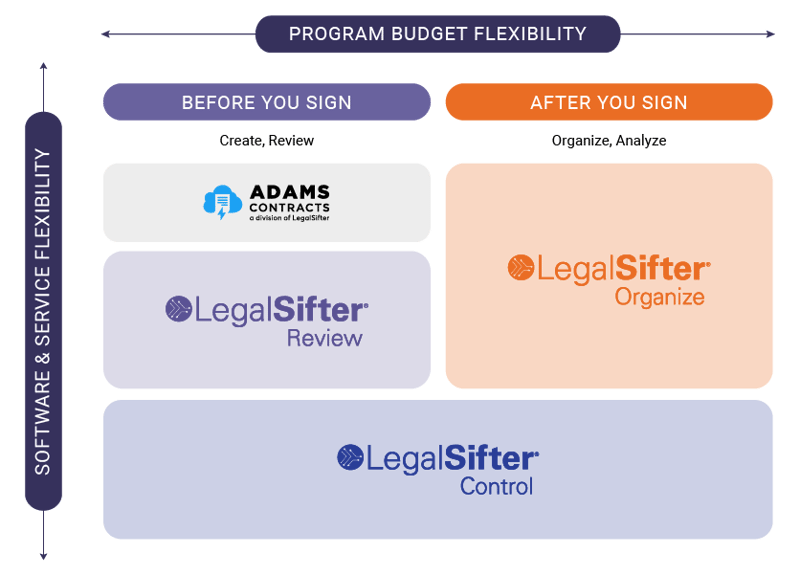

The Contract Control Program can include any combination of LegalSifter solutions:

Build your own subscription.

Build the right Contract Control Program for your organization.